A multigenerational Wyoming rancher challenges a billion-dollar wind and hydrogen project, raising questions about political influence, environmental oversight, and the true cost of clean energy.

When Mike Stephens filed a lawsuit to stop a $1.7 billion wind and hydrogen project from overtaking his family’s 113-year-old ranchland, he didn’t just take on a developer—he challenged the entire political and financial machine driving Wyoming’s energy future. What’s really behind the fast-tracked approval of Pronghorn H₂? Follow the money, and the story gets a lot more complicated.

A Generational Stand

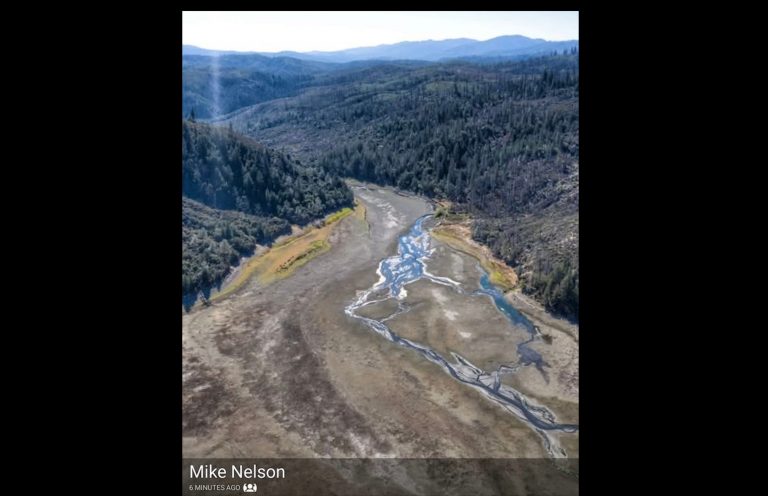

Nestled against the Laramie Mountains outside Glenrock, Converse County rancher Mike Stephens watches over land his family has stewarded since 1912. It’s this same rolling prairie that will soon host massive turbines looming over his seventh-generation legacy. On June 2, Stephens filed a “Petition for Review of Administrative Action” in Wyoming’s Eighth Judicial District Court, challenging the April approval by the Wyoming Board of Land Commissioners for the Pronghorn H₂ wind and green hydrogen lease—a sprawling 13,838 acres of state trust land now earmarked for development https://cowboystatedaily.com/2025/06/02/ranch-family-files-lawsuit-to-block-wyoming-wind-lease-citing-generational-legacy/.

Stephens isn’t accusing the Board of malice; instead, he argues they bypassed proper procedures. His suit claims inadequate environmental vetting, insufficient bond provisions for potential abandonment, and a failure to secure proper water, wildlife, and cultural safeguards. For Stephens, this isn’t just land—it’s his family’s future. “If they go a 45‑year lease, they’ll never see the view I see,” he told Cowboy State Daily.

What’s at Stake: The Pronghorn H₂ Proposal

The Pronghorn H₂ project—a joint venture of Acciona & Nordex Green Hydrogen (ANGH) and developer Focus Clean Energy—plans a 302.5 MW wind farm across 46,000 acres, generating power for an adjoining green hydrogen facility https://www.tsln.com/news/wyoming-wind-projects-causing-rifts-in-communities/. Backed by $1.7 billion in private investment, the wind-only portion on state land (13,838 acres) is projected to generate $365,750 annually—or about $31.5 million over 40 years for Wyoming schools and trust beneficiaries . The entire project, including employment and tax revenue, could produce more than $471 million in local and state taxes over 35 years.

Who’s Funding the Push

According to the project’s own “About” page, ANGH—a JV between Spanish goliath Acciona and Germany’s Nordex—along with Colorado-based Focus Clean Energy, are behind the initiative https://www.pronghornh2.com/about.

- Acciona brings international clean-energy scale, with U.S. presence in Chicago .

- Nordex supplies global turbine expertise and green hydrogen R&D .

- Focus Clean Energy has delivered over 1,700 MW of wind in Wyoming (e.g., Boswell Springs) and steers project development with local knowledge https://glenrockind.com/content/46000-acres-17b.

State support also flows through the Wyoming Energy Authority (WEA)—which has committed over $20 million in matching funds for hydrogen projects like Pronghorn H₂ pronghornh2.com.

Why Funding Matters in This Case

Though the Board of Land Commissioners is independent and composed of five statewide elected officials, the financial stakes are enormous: a $1.7 billion project plus tens of millions in lease and tax revenues. Governor Mark Gordon (Board chair) and his allies see Pronghorn as a cornerstone of Wyoming’s “all of the above” energy transition. Indeed, the board moved swiftly in April—voting 4–1 to approve the lease, a process opponents argue was rushed.

This isn’t a conspiracy, but a classic case of economic incentives shaping action. With private capital, global energy players, and state grants in play, the board had every reason to fast-track approval—even as local voices like Stephens’ were overshadowed.

What’s Next

Stephens and his attorney are preparing a legal brief for late June, poised to challenge:

- Whether the Board complied with Wyoming’s wind leasing rules

- If the lease ensures adequate decommissioning bonds

- Whether cultural, wildlife, and water protections were lawfully considered

Meanwhile, environmental and siting agencies like the DEQ’s Industrial Siting Division must still grant final approvals—offering further opportunities to weigh community concerns.

Final Thoughts

Mike Stephens’ challenge spotlights a tension at the heart of Wyoming’s energy future: rapid development and massive investment weighed against deep-rooted family legacies and environmental integrity. Acciona, Nordex, Focus Clean Energy, and the state authority are aligned behind a project billed as a once-in-a-generation economic boon. But for Stephens and many locals, it’s more than infrastructure—it’s personal. As the case unfolds, it will test whether big energy money and state-level incentive structures can run roughshod over procedural norms and the rights of the few few still calling Wyoming ranchland home.